Yesterday marked a six-day winning streak for the three big indices…

The S&P 500 gained almost 1% the first day of trading – its best start since 1987. The NASDAQ gained 1.5% in yesterday’s trading session. And the Dow ran up to new highs in five of the last six trading days – and continues to trade above 25,000.

Quite an impressive move to kick off the year…

The real question now is whether or not this historical bull rally will continue for the rest of the year.

And the answer lies in this this time-tested pattern…

What the “January Effect” Means for Your Money This Year

You may have been hearing some media chatter lately about something called the “January Effect,” which refers to a seasonal pattern in which stocks are anticipated to show a bit more bullish resolve in the last week of the year and the first handful of days of the next. Now personally, I’m not one to make any trading or investing decisions based on that theory.

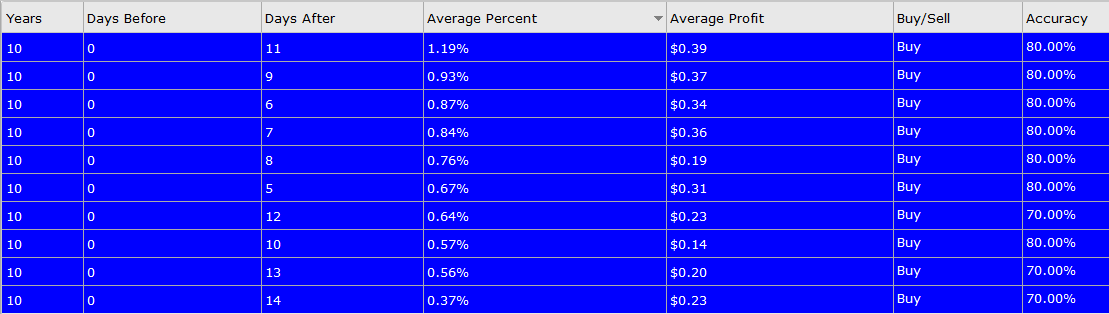

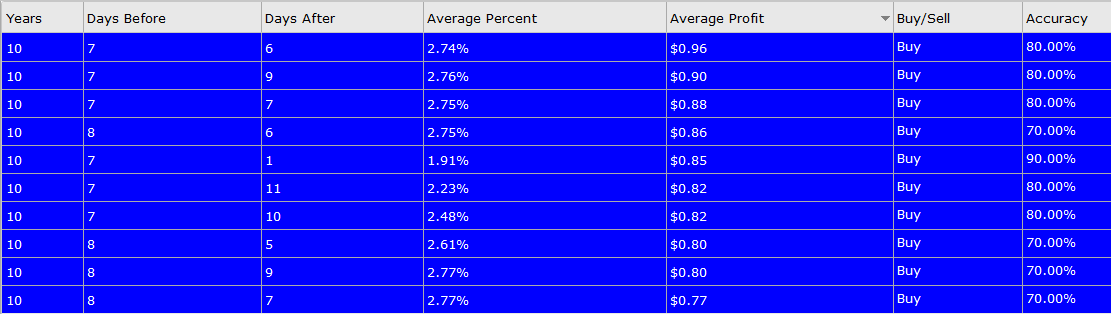

Instead, I turn to the technical and my tools, like Money Calendar. This is one of a suite of proprietary tools, and it that crunches 10 years’ worth of information on millions of data points to pinpoint the lowest-risk, highest-probability trading opportunities in the market. But it doesn’t make an assessment on the entire market – just the cream of the crop 250 stocks that you can get in and out of effortlessly.

In fact, when my patent-pending system’s at work, it crunches through 10 years of daily transactions and billions of data points to find countless trading opportunities that could double your money or more in 30 days or less (like the 193.39% we scored in GLD just last week). See this incredible “money machine” in action, right here.

As you know, the January Effect focuses on the first five trading days of the year because data shows there’s an 86% chance the overall markets will trade higher for the year when the S&P 500 trades to a net positive gain during that time frame. In fact, this has happened in 31 of the last 36 years. And based on the numbers from these past six trading days, the rest of 2018 is looking pretty good.

But there’s more than just the January Effect to consider…

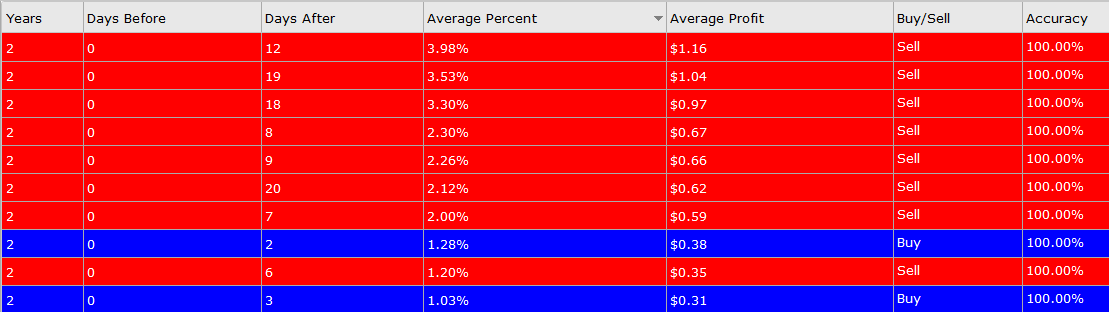

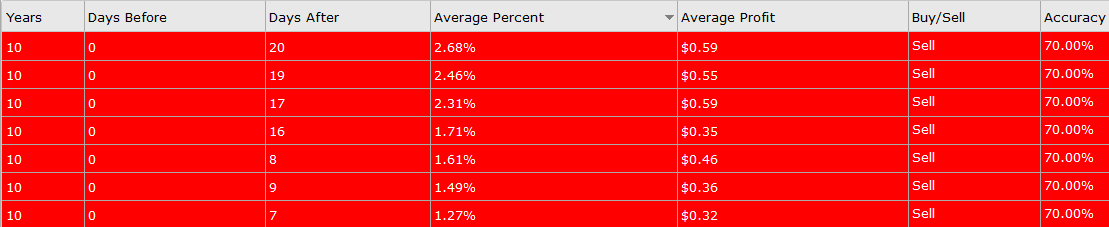

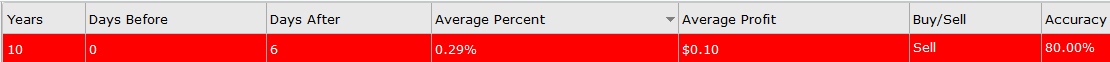

That’s why right now, I’m looking at the Select Sector SPDR ETF’s, which are a series of unique exchange traded funds that divide the S&P 500 into 10 index funds and what they’re showing in terms of performance over a slightly longer duration: January 1 through January 19 (the standard third-Friday-of-the-month expiration).

And here are the results for the first 20 days following the New Year…

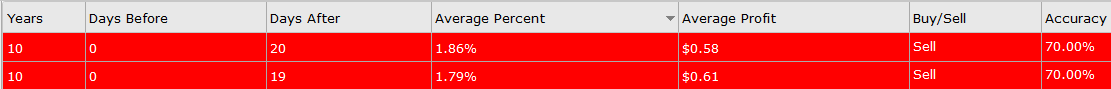

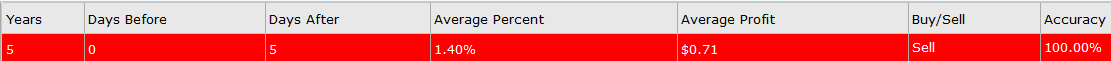

XLY: Consumer Discretionary Select Sector SPDR ETF

XLP: Consumer Staples Select Sector SPDR ETF

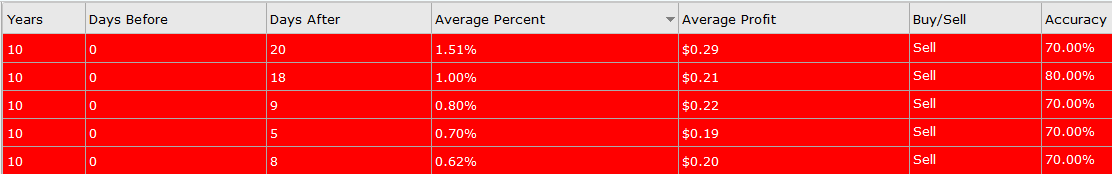

XLP: Consumer Staples Select Sector SPDR ETF

XLE: Energy Select Sector SPDR ETF

XLE: Energy Select Sector SPDR ETF

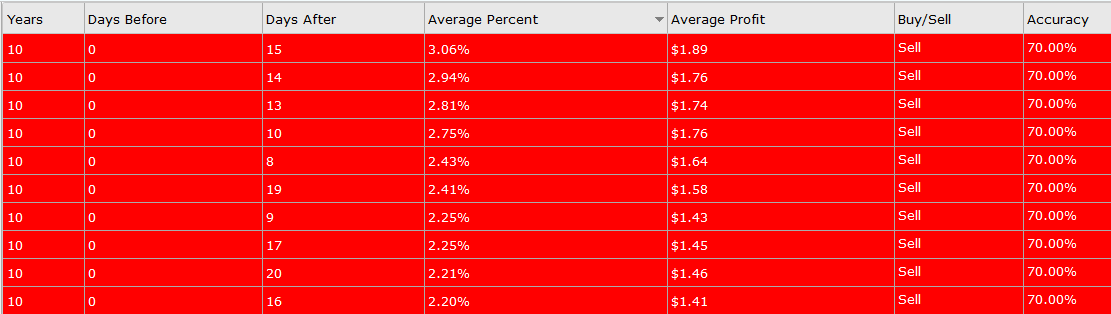

XLF: Financial Select Sector SPDR ETF

XLF: Financial Select Sector SPDR ETF

XLV: Health Care Select Sector SPDR ETF

XLV: Health Care Select Sector SPDR ETF

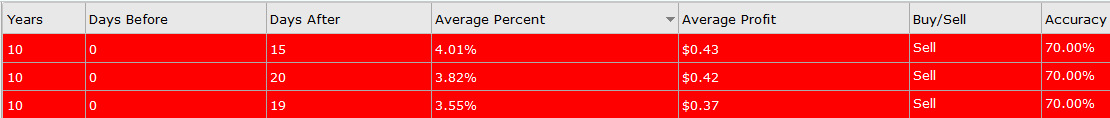

XLI: Industrial Select Sector SPDR ETF

XLI: Industrial Select Sector SPDR ETF

XLB: Materials Select Sector SPDR ETF

XLB: Materials Select Sector SPDR ETF

XLRE: Real Estate Select Sector SPDR

XLRE: Real Estate Select Sector SPDR

XLK: Technology Select Sector SPDR ETF

XLK: Technology Select Sector SPDR ETF

XLU: Utilities Select Sector SPDR ETF

XLU: Utilities Select Sector SPDR ETF

As you can see, the only two sectors that actually show a batch of positive gains during that time frame are the Materials and Health Care ETFs. All the others actually show a slight percentage decline. Personally, I wouldn’t mind a pullback… I feel it could be healthy for the markets, honestly. On top of that, it’d present a buying opportunity, in my eyes, in the sectors that are still worth believing in.

Keep in mind… I’m not bringing this information and data to your attention so you can go bearish and start initiating long put option trades. In my view, the better plan is to look for the stocks you like to trade to pull back to their prior resistance levels – and wait to see if they bounce off of those levels. That’ll give you the perfect setup for long call option trade ideas. On my end, I’ll still be using my Money Calendar to scan for the best trade ideas, but I can see a balance of long call AND long put trade considerations coming our way in the front month of the New Year.

Now let me reiterate…

I’m not saying to go long puts only, and I am not saying I am going to start trading like a banshee right out of the gates. This data shows the possibility some bearishness could settle in despite the prospects of the January effect kicking in. And what I’m looking for are the best opportunities that’ll present themselves if that does happen.

One las thing…

I am a big proponent of buying the rumor and selling the news. I’ve seen it happen often in my 30+ years of trading, and now that the tax reform bill goes live on February 1, a pullback may happen based off that trading axiom, too. When it does, the best thing to look for are target prices for stocks to pull back to- and be ready to go long once it does.

If you’re asking, “why not buy puts, Tom?” – Well, you know as well as I do that it’s tough – and extremely costly – to try and call a top. Instead, it’s better to wait for that top to happen and then find an opportunity once the top has been put in place. And according to all the data, that could come in as little as the next two to three weeks.

In the meantime, I’ve got my eye on two other ways for you to kick of your income stream.

So stay tuned…

And now, a word from Quant Strategist Chris Johnson…

Hi there Power Profit Readers,

We’re just days into the New Year. And if you’re like millions of other Americans, you made a resolution to make life-changing decisions this year to improve your finances. But when it comes to bringing these resolutions to life, your best bet is to make your own path…

That’s why I became a Night Trader. I was sick of playing by Wall Street’s rules and getting nowhere. I was tired of waking up at 6 AM …. tired of staring at a computer screen for 10 hours a day… tired of the stress… the frustration… and the stubborn bullpen mentality.

So I turned my back on everything that’s brought me my fortune.

Now, I live the life I choose. I have complete freedom to do whatever I want, when I want, how I want.

And, I’m on pace to see total winning gains of 3,390% per year…

That’s enough to turn every $5,000 into $174,500.

To my knowledge, I am the ONLY person on the planet who trades at night using my proprietary approach.

And it all comes down to these three simple rules…

To your continued success,

Tom Gentile

America’s #1 Pattern Trader