Claim Your Discount: Tom Gentile’s next Million Dollar Masterclass is available for just $1. The next one takes place on Tuesday… and during this special event, you’ll learn how you can score triple-digit gains over and over using his special “butterfly trade.” Click here to claim your discount now.

Dear Power Profit Trader,

There’s a famous saying when it comes to trading that goes like this:

“Bulls climb up the stairs and the bears fall out of the window…”

In other words, this means stocks often fall faster than they rise.

In fact, if you’re not playing the downside, you’re leaving big and fast profits on the table.

But you don’t have to short stocks to cash in on this – there’s actually a much better way.

And today, I’m going to show you exactly how to cash in on the bear and protect your wallet while you’re at it.

Here’s what I mean…

Play the Downside with Puts for Faster and Bigger Profits

Adding a bearish setup to your portfolio can be a very good thing and can lead to bigger and faster profits – if you know the right way to do it.

Now, when I say bearish, you’d might think that shorting stocks is the only way to go about it.

Shorting stock is done by selling the stock first and buying it back later.

Yes, your broker will actually allow you to do that!

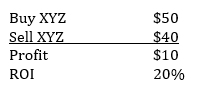

For example, if you were to sell XYZ at its current price of $50 and buy it back later after a fall for $40, you’d make $10 per share or 20% profit.

Of course, your broker won’t just let you sell something without risk in the game, so they’ll hold the cost of the stock as margin in your account.

Trading stocks in this way, or any way for that matter, is great.

But as I introduced last week, there’s a better way to play the market – and that’s with the power of options.

Now, last week we used call options on bullish stocks to:

- Spend Less (Leverage More Stock)

- Reduce Risk

- Increase Profits 10-Fold

But I’ve got more coming your way…

This week, we’re going to “put the battery in the other way around” and profit to the downside with put options.

A put option provides you the right to sell a specific stock at a specific price (strike) until a specific date (expiration). Puts increase in value when the underlying stock moves down in price and vice versa. One put contract controls 100 shares of stock just like calls.

Puts are very much like insurance. In fact, they can be used to protect stock in the same way as insurance. But this insurance policy gives you the right to sell (put) the asset at an agreed to price for an agreed to amount of time.

Let’s take a look at an example on the S&P 500 ETF (NYSE: SPY)…

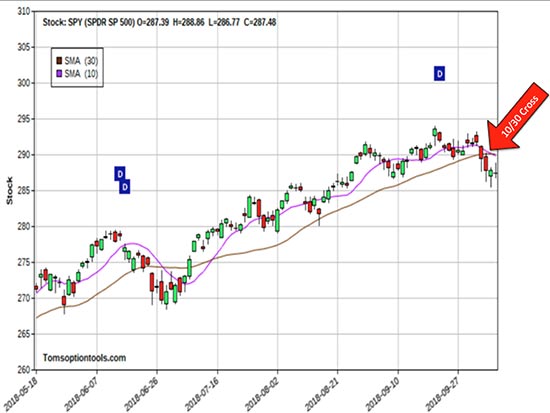

On 10/9/18, the SPYs came up on my 10/30 Moving Average Crossover scan signaling a bearish move. (Now, you might recognize the 10/30 MA Crossover from past articles – so you can learn more about this by clicking here.)

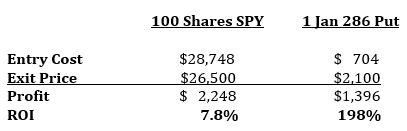

If you were to short (sell) 100 shares of

SPY at $287.48 on 10/9/18, you’d spend $28,748.

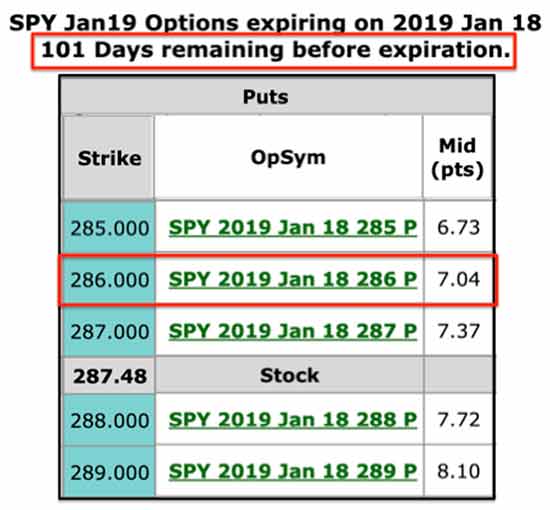

On the same date, a SPY January $286 put would cost $7.04 per share or $704 to control 100 shares of stock. This put option would expire on the third Friday in January, the expiration date.

Now, before we continue, let’s look a little closer at the benefit of trading options in this scenario instead of buying the stock out right…

Point #1: Spend Less (Leverage More Stock)

Options allow you to leverage large amounts of stock for a lot less money. In this case, the puts are $28,044 (96%) cheaper than shorting the stock.

Point #2: Reduce Risk

The maximum risk of buying options is the amount you spend (your debit). The most you could lose in this case is $704. Obviously, you could lose A LOT more on the stock position.

So, here’s how these two trades worked out.

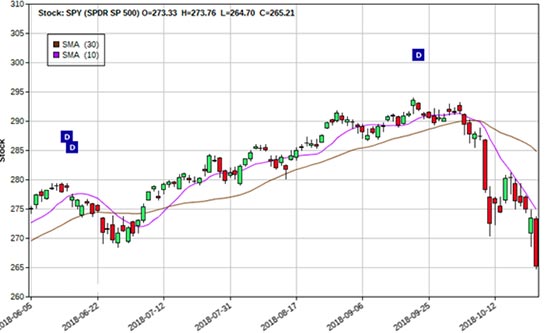

On 10/24/18, the SPYs came to rest on strong support of $265… a $22 (7%) drop in 15 days!

Look at the gradual rise in the stock beginning in late June 2018 and the plummet that occurred in the last two weeks in the chart.

This is a great illustration of the bull climbing the stairs and the bear falling out of the window!

The

SPYs fell from $287.48 to $265 providing a $22.48 per share profit. 100 shares of stock netted us $2,248 (8%) profit in just over two weeks.

On the other hand, our put option was worth $21 netting a profit of $13.96 per share. At 100 shares of stock controlled, that equates to a $1,396 (198%) profit. Now, those are the kind of gains I like to see…

Let’s summarize:

In this case, our ROI was over 25 times larger with puts versus shorting stock!

We also spent A LOT more than those who shorted the stock…

And remember, you can buy more than one put position. Had you bought two puts, you’d have spent $1,408 and netted $2,792 profit.

Now, buying options generally increases ROI by 10-times over long stock. In our case, the SPY puts produced over 25-times the ROI than the short stock position. And that’s just one example of the explosive profits you can grab with the power of put options.

To get you started with puts, here are some simple rules to follow:

Puts Entry Rules

- Buy put options one-two strikes lower than stock price with…

- The expiration date should be 90-120 days out.

The SPY option table below illustrates these entry rules for the example used above.

You can access option data tables online or with your broker. One free site to try is the Chicago Board of Options Exchange (CBOE) site.

Put Exit Rules

- 50% Stop Loss

- 30 Days to Expiration*

- Technical Exit

*Note: Options begin to lose more of their value in the last 30 days of life.

The final benefit of bearish trading – speed. There are a few ways to play a bearish turn, but there’s one in particular that can hand you cash in seconds.

I’m talking $940 in 11 seconds… $1,260 in 8 seconds… even $988 in 7 seconds. Sound crazy? Let me show you – with a timer – how this is absolutely possible. Click here to see this in action now, and to learn how to put this strategy to work today.

If you haven’t yet gotten into the world of bearish trading, there’s never been a better time…

So, follow these simple rules above and dive in. You’ll be glad you did!

Good Trading,

Tom Gentile

America’s #1 Pattern Trader