[MUST SEE] This is really intense… but worth watching to potentially protect your capital now

The Dow is on track for its best week since 1938 – but that doesn’t mean it’s all blue skies ahead.

Last week’s unemployment claims, released Thursday morning, soared to an unprecedented number of 3.3 million – the highest in history. Second place isn’t even close, with the previous high sitting at just 695,000 in 1982.

Never in my lifetime could I have imagined an event like this. With businesses across the country shutting down, the economy is in danger of plunging into a full-blown recession – and there seems to be nothing we can do to stop it.

The word “recession” is scary. But it’s not the end of the world… not even close.

In fact, you could come out of it even stronger than you were before.

Here’s how you can make a short-term profit on the market’s fall – and a long-term profit on its eventual recovery…

Based on the numbers coming from the Centers for Disease Control and Prevention (CDC), the coronavirus pandemic should run its course by the end of July if it continues on its exponential trend.

The stock market, however, is typically two to three months ahead of everything else. If the pandemic lasts through July, then I expect the market’s bottom to hit by the end of April.

Now, the move higher from there will be slow. It could take until the end of the year before the market begins to rise significantly. But there’s a lot you can do until then…

- Risk less by using options in place of stocks. At the start of this year, I had about 50% of my money invested in stocks and options. Last month, I bumped my cash position up to 75%. In the last two weeks, I have let options expire, sold off the few long-term holdings I had left over, and am now nearly 90% in cash and 10% in stocks and options.

- Find what’s going up in a down market. In March, this consisted of bonds, the eurodollar, and gold. In April, I think it’s going to be the U.S. dollar, and believe it or not, natural gas.

- Exploit volatility. This will continue to be most important now. This means reducing risk with options spreads and getting breakevens closer to the market. Just keep in mind that that bid/ask spreads will continue to widen as volatility rises.

You should follow this philosophy… but with one additional caveat.

How to Make a Short-Term Profit on the Fall

History tends to repeat itself in the stock market. I’m a pattern trader, after all. That’s a fact I’ve made my entire fortune on. And history says that this is far from over…

Back on October 9, 2007, the Dow hit an all-time high, closing at 14,164.53. By March 5, 2009, it had dropped more than 50% to 6,594.44. But this wasn’t a straight line down. Lower highs and lower lows took nearly 17 months for this pullback from start to completion.

The worst of the financial crisis was in September and October of 2008. Though we did push lower 90 days following this, these were the two worst months on record as volatility had skyrocketed.

That’s two months of chaos.

Fast forward to today, and we are predictably only halfway through… with the worst possibly yet to come. We could have another 20% to go.

So for the next 30 to 60 days, we should get bearish. That means bearish put spreads on the SPDR S&P 500 ETF Trust (SPY), going deep out-of-the-money (OTM), looking for those 9-1 or 10-1 reward-to-risk ratios using April options.

Even if we’re wrong on this, we won’t lose much – that’s the beauty of these low-risk put spreads.

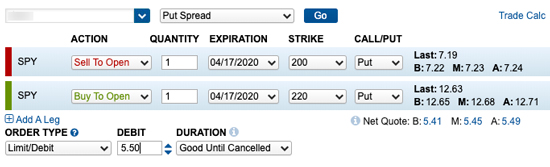

A put spread consists of buying higher strike puts and selling lower strike puts simultaneously. The put option you sell helps pay for the put option you buy, thereby lowering the cost of the trade overall. And with volatility at multiyear highs, you want to create low risk trades.

Take this bearish April put spread, for example. You’re selling the $200 put for $7.24 and buying the $220 put for $12.65, bringing your total to just under $5.50, or $550 for control over 100 shares.

This is less than half of the cost of simply buying the OTM put, which would cost over $1,265!

How to Make a Long-Term Profit on the Recovery

Although it may take a while for the market to recover, it will recover. And with this strategy, you can profit when it does.

I’d suggest using LEAPs, short for long-term equity anticipations. Look at that last word for a moment – anticipations. We anticipate that the market will recover – and we want to give ourselves plenty of time to be right.

Basically, a LEAP is just a long-term option with more than nine months to expiration. When it comes to the eventual recovery, this is exactly what we want.

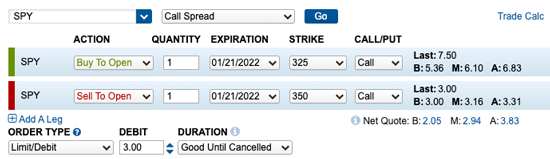

Just like the bearish example above, we want to trade the upside using spreads. But instead of puts, we’ll use bull call spreads. And we don’t want to use a typical option – we want to use LEAPs to give ourselves plenty of time for the recovery.

A call spread involves buying lower strike calls and selling higher strike calls. This is done for lower cost, lower risk, and a lower breakeven.

Here is an example below using 2022 options on the SPY, nearly two years from now.

As you can see, buying the $325 call while selling the $350 call brings your total to just about $3.00, or $300 for control over 100 shares – a bargain compared to the $750 the long call would run you.

Now, this case study has a 7-1 reward-to-risk ratio. That means if the SPY were to trade back up near its pre-crisis highs, this spread would have a 700% profit potential!

It’s impossible to truly know what the future holds right now. A vaccine could be created, or the world could temporarily shut down to eradicate the virus completely.

No matter what happens, know this – we will come out on the other side better for it. Especially if we use the strategies above.

One Secret Can Profoundly Reshape Your Portfolio (with One Hour a Day)

If you’re focused on ways to grow and protect your money right now, you have to see what’s happening in Andrew Keene’s Live Trading Room. Folks are simply following his up-to-the-moment instructions… working just one hour a day… and getting a chance to grow their net worth exponentially. Go here to watch a live session.

Stay safe,

Tom Gentile

America’s #1 Pattern Trader