In the past month, Tesla Inc. (NASDAQ: TSLA) has gone from around $400 per share to over $600 per share.

That’s a 50% gain in as little as 30 days. And in the same amount of time, it’s handed option traders 1000%-plus gains – call worth $20 in mid-November is worth $200 today!

And there’s even more coming for TSLA…

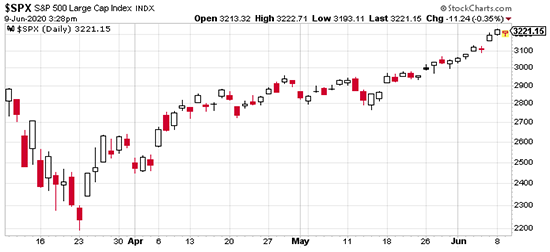

At the sound of Friday’s closing bell, the electric automaker will be added to the S&P 500 in what’s sure to be a historic day for the markets.

See, the heaviest days of trading tend to be on the days of major index rebalancing like we’ll see this week. Meaning TSLA‘s headline-making days are far from over.

The question is – where do we go from here? Is TSLA‘s inclusion in the S&P a sell-the-news event, or is the stock set to go even higher from here?

Well, the answer doesn’t matter. Not if you’re using the strategy I’m going to show you today, anyways.

This strategy isn’t bullish or bearish. It’s neutral, and it has a sky-high probability of profit.

Plus, it has the potential to hand you at least $1,000 by Friday.

I’ll break down this trade in the video below. Check it out…