Complete the actions to take below. You can follow along with my video by clicking “Read Cash Course: Part 4”.

Action to Take

Go to the Fast Fortune Network and share what you’d do with your very first million dollars. It can be something you pay off, something you buy, somewhere you go – whatever it is, share it with the club.

In Part 3, I asked you to share what you think is the number one mistake people make in the stock market each and every day.

Now some of the responses I received from my Fast Fortune Club readers included:

- “Dollar cost averaging money they don’t have”

- “Putting all of their eggs into one basket”

- “Buying expensive stocks one share at a time with no backup plan in case it moves in the wrong direction”

And I agree! These are some pretty bad mistakes…

But it’s not their fault – they’re trying their best to follow the “advice” they’re getting from Wall Street, such as dollar-cost averaging their way into the big-name stocks.

The problem is the people giving that advice don’t care about your bottom dollar at the end of the day – they care about lining their pockets with your hard-earned cash. And in the cases above, these investors lost a lot of money that will take a long time to get back through any traditional form of investing (if at all).

Traditional forms of investing like this old buy-and-hold method Wall Street wants you to use will get you nowhere – and fast. We covered a couple of other examples of this already.

So it’s time we talk about “flipping” stocks INSTEAD of buying and holding them.

What most of the billionaires and hedge fund managers on Wall Street want you to believe is that options are too risky, too complicated, and simply not worth your time. They’d rather have you dump hundreds of thousands of dollars on the most expensive stocks out there – so they can take the profits. And they’re counting on the misinformation they’ve put out there about options to keep it that way.

The truth is… the entire reason listed, exchange-traded options first launched in 1973 was to mitigate risk in the stock market and give you leverage. When you buy a stock, you’re at the mercy of the markets, which could cost you big time. In fact, U.S. stocks are more expensive now than ever before. So, for example, if you want to buy one share of Amazon.com, Inc. (NASDAQ: AMZN), you would have to spend well over $1,500 dollars… for a single share. And more often than not, people want to own more than a single share of stock in their portfolios.

But with options, you can actually control 100 shares of expensive stocks, like AMZN for less than $500. So while Wall Street wants you to shell out over $150,000 for 100 shares of AMZN, you don’t have to. You could pay $500 or less to essentially “rent” 100 shares of the stock, instead. And since you can control shares of a specific stock, you can also increase your leverage without tying up a large amount of capital in your trading account. In fact, most brokerages only require a deposit of only $2,000 or less to get started.

The Wall Street guys don’t want you to know this.

They also don’t want you to know how easy it is to make money with options – and how much of it you can actually make. They want you to believe that it’s simply “too good to be true.” But it’s not. Options offer an amazing versatility that you can use in a variety of ways to profit from the markets, whether it’s up, down, or sideways. And in times of high market volatility, options can act as a financial “escape” from the uncertainties of traditional investing methods.

How “Flipping Stocks” Can Double Your Money Faster than Anything Else on the Planet

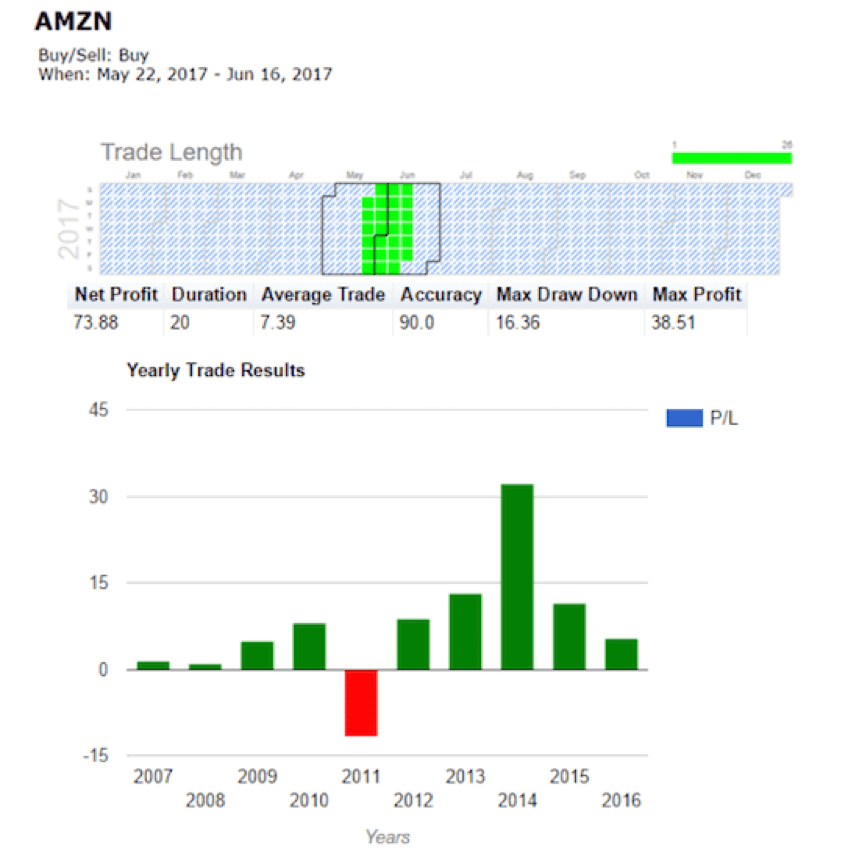

Let’s take at a real trade I recommended to my premium subscribers in May 2017 on Amazon.com, Inc. (NASDAQ: AMZN)…

Back then, things were looking real good for the company – and the stock. Now, knowing that, you could’ve easily followed Wall Street’s playbook and taken the traditional, conservative route: buy shares.

But at the time, AMZN was trading a little over $1,000 per share. That means you’d need to fork out over $1,000 to add one measly share of stock to your portfolio. And let’s be honest… owning one single share of AMZN won’t be enough to supplement your income – or cover that dream vacation you’ve been wanting to go on.

Plus… since you’re buying stock shares outright, you could theoretically lose every single one of those dollars you put in if the stock plummets to zero. That’s $1,000 in the hole (unless you bought more than one share).

Now in my book, that’s not worth the risk – not even a little.

And that’s exactly why we trade.

In fact, members of my premium trading service got the opportunity to “rent” 100 shares of AMZN – for only $371. That’s nearly a 62% discount on the stock – 99 additional shares.

Imagine buying 100 shares of AMZN the way Wall Street wants you to – that’d cost you no less than $100,000.

This is the kind of cash Wall Street wants you to spend – knowing you’ll need to keep dumping this kind of money for years before you even see any kind of significant return.

But my members, using the same strategies I’m going to show you, had the chance to pocket 260.92% total gains – over a 16-day period.

Here’s how…

My Money Calendar showed me that AMZN made an upward move in nine of the last ten years.

This told me that there was a 90% probability that it would move in this direction again over the trading date range and that we only needed it to move by less than four points to hit our double.

In only six days, we made 111% on this trade – even better than what my Money Calendar predicted.

Look at how one of my subscribers did:

“In less than 24 hours… $8,580 profit for AMZN!”

Here’s another example of how you can play the most expensive stocks in the market – for pennies on the dollar…

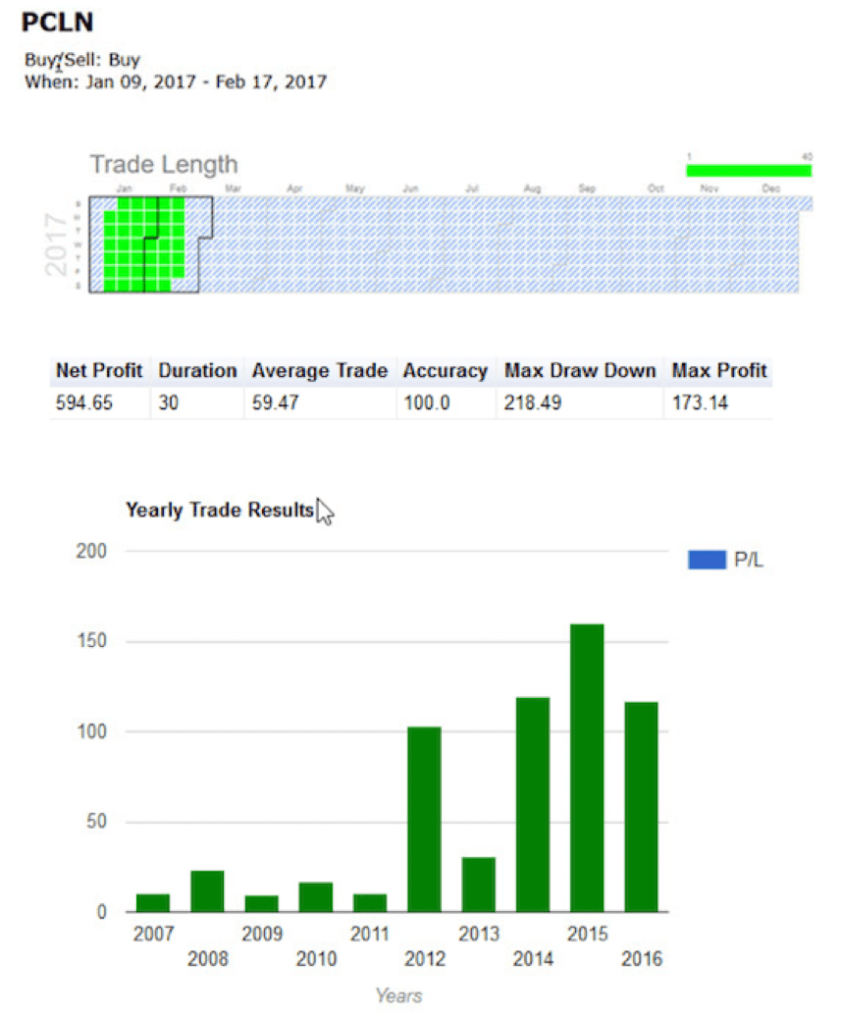

Booking Holdings Inc. (NYSE: BKNG)

At the time I was interested in trading BKNG, the stock was trading around $1,529.64. So if you wanted to buy a single share of BKNG, you’d be looking at paying no less than that for one share. And if you wanted 100 shares, you’d have to shell out $152,964!

Again, this is the “traditional” way to do things… according to Wall Street.

But not me – think of all the different things you could do with that kind of money BEYOND buying one share of stock.

On top of that, I don’t believe in risking more than $500 on a trade.

So here’s what we did…

The Money Calendar showed me that BKNG made an upward move every single year during this time frame – without fail…

And before this pattern even ended, we more than doubled our money – closing the trade out for a combined 344.13% gains.

Here’s what a couple of my subscribers had to say…

“I tracked the buy and sell for the PCLN trade the other day, and I made 271.6% by my calculations.”

“I had $1,625 on PCLN and sold for $3,225 for a 195% gain.”

As far as options being too complicated… couldn’t be further from the truth.

Options are extremely easy to trade when you know how to use them – which is exactly why I’m here.

I’ve been trading and teaching options for nearly 30 years, and I love every bit of it. I know that options are the key to transforming your life – they changed mine – and I know they’re the key to changing your life, too.

You can make money on a daily, weekly, or monthly basis without a morning commute, long work hours, overtime, or any type of physical labor. And the only boss you need to worry about is yourself.

And in Part 5, I’ll show you just how easy it is to get started…

Click the green button at the bottom of this page to continue to Part 5.

Q. What’s the number one mistake people make each and every day in the stock market?

A. Dollar cost averaging money they don’t have

B. Putting “all of their eggs” into one basket

C. Buying expensive shares of stock outright instead of trading options

Q. How many shares of a stock or ETF can you control per each contract?

A. 10

B. 50

C. 100

Q. This is not a benefit options trading provides over stock investing…

A. Leverage

B. Slow profits

C. Low cost