Heads Up: The S&P is down over 14% year-to-date. But these traders aren’t playing stocks – and they’re up 74.38% since January 1. Find out how to tap into this little-known market right here.

Filling your tank is about to get cheaper.

An oil price war between Saudi Arabia and Russia erupted on Monday morning, causing U.S. crude to fall 26% for its worst day since 1991.

See, the two countries are increasing their oil supply at a time when demand is low, with travel decreasing due to the coronavirus. Add increased supply and decreased demand together, and you get oil prices at 18-year lows.

But there’s an opportunity hidden beneath the rubble of the commodity’s crash – and I don’t just mean cheap gas.

Famed investor Warren Buffett said it best: “Be fearful when others are greedy. Be greedy when others are fearful.”

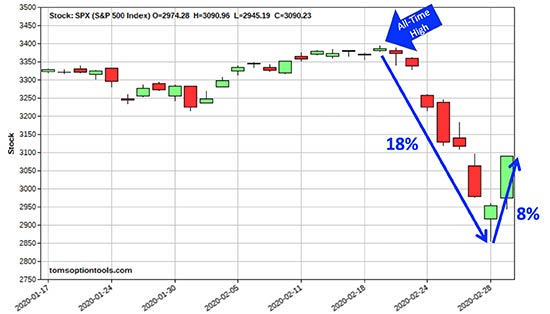

With the market’s fear gauge, the CBOE Volatility Index (VIX), at its highest level since the 2008 financial crisis, you can’t deny that fear is rampant in this market…

Meaning now is the time to buy.

Take advantage of low oil prices right now with these six plays…